From Valentine's Day by , August 24, 2011 at XKCD.com.

About mind, government, climate, economics, health, politics, science, ..., and a touch of humor.

From Valentine's Day by Randall Munroe, August 24, 2011 at XKCD.com.

Wow! Between 1980 and 2008 the bottom 90% of U.S. earners received 2% of income growth and the top 1% got more than half, says When Income Grows, Who Gains? by Economic Policy Institute, August, 2011 at The State Of Working America.

One in five major civil conflicts since 1950 may be linked to climate extremes associated with El Niños — periods of warming lasting a year or longer in surface waters of the central equatorial Pacific, a new study finds.

I'm one of those people who would be generally skeptical about correlating things to climate,says statistician Andrew Solow of the Woods Hole Oceanographic Institution in Massachusetts. But the new report's finding makes sense, he says: In poor countries where the economy is closely linked to agriculture — and therefore the weather — poor harvests and diminishing food supplies can leave large numbers of people available to engage in civil uprisings.Hsiang and his colleagues analyzed 234 civil conflicts that broke out within 175 nations between 1950 and 2004. In any given year, the probability that a new conflict would erupt among the 90 or so nations whose climates can be heavily affected by El Niño events was 4.1%. That's twice the conflict rate in countries largely immune to El Niño effects, Hsiang's group reports in the Aug. 25 Nature.

This disparity in violence rates is huge, Hsiang says: It's comparable to differences that others have reported between populations where annual incomes were $1,000 per capita versus $10,000.

For more, see EL NIñOS May Inflame Civil Unrest by Janet Raloff, August 24, 2011 at ScienceNews.

The following suggests that intellectual property assests are not accounted for properly ...

Take the story of Dell Computer [DELL] and its Taiwanese electronics manufacturer. The story is told in the brilliant book by Clayton Christensen, Jerome Grossman and Jason Hwang, The Innovator's Prescription :ASUSTeK started out making the simple circuit boards within a Dell computer. Then ASUSTeK came to Dell with an interesting value proposition:

We've been doing a good job making these little boards. Why don't you let us make the motherboard for you? Circuit manufacturing isn't your core competence anyway and we could do it for 20% less.Dell accepted the proposal because from a perspective of making money, it made sense: Dell's revenues were unaffected and its profits improved significantly. On successive occasions, ASUSTeK came back and took over the motherboard, the assembly of the computer, the management of the supply chain and the design of the computer. In each case Dell accepted the proposal because from a perspective of making money, it made sense: Dell's revenues were unaffected and its profits improved significantly. However, the next time ASUSTeK came back, it wasn't to talk to Dell. It was to talk to Best Buy and other retailers to tell them that they could offer them their own brand or any brand PC for 20% lower cost. As The Innovator's Prescription concludes:

Bingo. One company gone, another has taken its place. There's no stupidity in the story. The managers in both companies did exactly what business school professors and the best management consultants would tell them to do—improve profitability by focus on on those activities that are profitable and by getting out of activities that are less profitable.

For more, see Why Amazon Can't Make a Kindle in the USA by Steve Denning, August 17, 2011 at Forbes.com.

Presidential candidate Rick Perry got a "D" in his only economic course.

Page 1 ...

Page 2 ...

For more, see Perry's College Transcript Is Brought to You by the Letters 'C' And 'D' by Tristan Hallman, August 5, 2011 at dallas news com.

In an as-yet-unpublished study, members of Dr Horselenberg's group told 83 people that they were taking part in a taste test for a supermarket chain. The top taster would win a prize such as an iPad or a set of DVDs. The volunteers were asked to try ten cans of fizzy drink and guess which was which. The labels were obscured by socks pulled up to the rim of each can, so to cheat a volunteer had only to lower the sock.During the test, which was filmed by a hidden camera, ten participants actually did cheat. Bafflingly, though, another eight falsely confessed when accused by the experimenter, despite participants having been told cheats would be fined €50 ($72).

To read about several more simple experiments, see Silence Is Golden, August 13, 2011 at The Economist.

Nice guys don't get ahead in salary negotiations, but they don't finish last either, a new study finds. That position is left for women, whether or not they're nice.Men with disagreeable personalities outearn men with agreeable personalities by about 18%, according to research to be published this fall in the Journal of Personality and Social Psychology. Disagreeable women, on the other hand, earn only about 5% more than their sweet and gentle counterparts.

For more, see Nice Guys Finish Second, Women Finish Last by Stephanie Pappas, August 15, 2011 at LiveScience.

More deleveraging to come ...

According to an analysis from Moody's Analytics, total household debt peaked in August 2008 at $12.41 trillion and has come down by about $1.2 trillion.As a proportion of gross domestic product, household debt peaked at 99.5% in the first quarter of 2009, and has come down to just under 90%.

Economists, who talk about the

deleveragingprocess, say that debt still has a way to come down before the economy will return to full health. Just how far it needs to come down, though, is difficult to say.As recently as 2000, household debt was less than 70% of G.D.P., and in 1990 it was around 60%.

For more, see How Far Should Consumers Unwind Debt? by Motoko Rich, August 15, 2011 at Economix.

For God and country—Geronimo, Geronimo, Geronimo.

For a long, good article Martha contributed see Getting Bin Laden by Nicholas Schmidle, August 8, 2011 at The New Yorker.

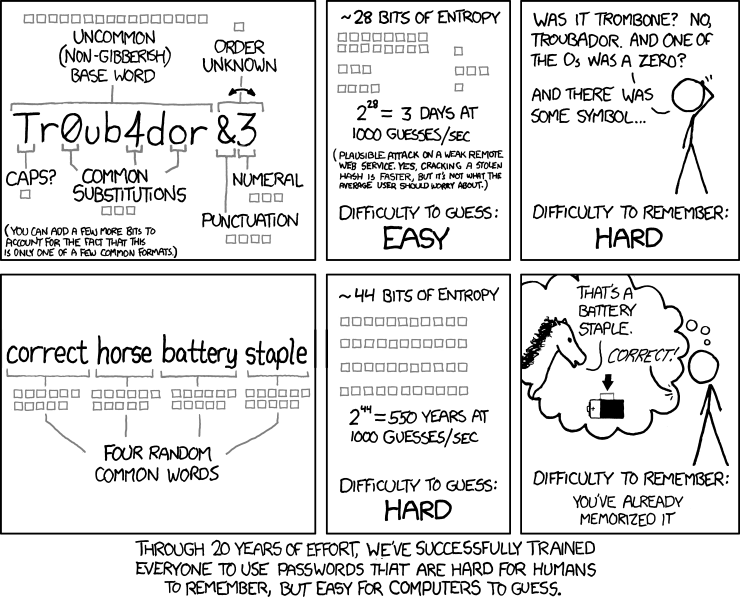

From Password Strength by Randall Munroe, August 11, 2011 at XKCD.com.

The unbalanced budget amendment is a requirement that in good times the government must run a budget surplus. The virtues of such a rule are that it allows for counter-cylical fiscal policy during a recession. Indeed, it reduces the cost of counter-cyclical fiscal policy because it guarantees a reserve fund for just such emergencies. The unBBA is thus a type of automatic stabilizer of the kind I have argued for before ....A simple version of the unBBA requires surpluses but more generally the rule would be a surplus or a similarly sized reduction from the previous year's deficit. The size of the required surplus/deficit reduction would be tied to a function of current and recent GDP growth rates.

For more, see An Unbalanced Budget Amendment by Alex Tabarrok, July 25, 2011 at Marginal Revolution.

It was no surprise when a recent meta-study found people with strong social support networks tend to live longer, healthier lives. As the Mayo Clinic notes on its website, having close, lasting relationships strengthens one's feelings of security, self-worth and sense of belonging.But there appears to be a dark side to those life-enhancing bonds. Newly published research suggests they may make it more likely you'll view those outside your social group as less than human —and treat them accordingly.

The most tightly knit groups — from military units to athletic teams — may also be the most likely to treat their adversaries as subhuman animals.

Being socially connected not only diminishes the motivation to connect with others, but may also diminish the perceived similarity with more distant others,they add,because social connections delineate those within one's social circle and those outside of it.In other words, people tend to identify with their fellow group members, meaning they're more likely to perceive outsiders as different. And as earlier research has shown, when people are viewed as dissimilar to ourselves,

they are evaluated as less humanlike as well.

For the experiments and more, see Strong Social Bonds Promote Health, Belonging — And Torture by Tom Jacobs, August 9, 2011 at Miller-McCune.

When the small, beleaguered city of Central Falls, R.I., filed for bankruptcy this month, it sought to cut the pension checks it has been sending its retired police officers, firefighters and other workers by as much as half. All the city promises now is that its retirees, many of whom do not get Social Security, will not have their benefits cut to less than $10,000 a year.But investors who bought the city's bonds could do much better: Rhode Island recently passed a law intended to make sure that they would be paid in full, even in bankruptcy.

Millions of teachers, police officers, firefighters and other government workers have long believed that their pensions were untouchable, thanks to provisions in state laws and constitutions. But some of those promises are unclear or untested, said Amy B. Monahan, an associate professor at the University of Minnesota law school who has studied the myriad laws protecting public pensions in different states.

In Central Falls, the pension plan for the police and firefighters is projected to run out of money in October. But officials there say short-changing the bondholders will not bring relief. The next time the city needs to borrow money, investors will simply demand more in interest, and they might decide all Rhode Islanders were a bad risk and charge all cities more.

The last thing we want to do is increase borrowing costs for all our cities and towns, and therefore cause tax rates to go up across the state, because one city has fiscal problems,said Robert G. Flanders Jr., the state-appointed receiver for Central Falls, explaining the new state law putting bondholders first in line.

For more, see Faltering Rhode Island City Tests Vows to Pensioners by Mary Williams Walsh and Michael Cooper, August 13, 2011 at NYTimes.com.

Researchers at IBM have developed a newcognitive computingmicrochip inspired by the brain's computational tricks.

IBM has made two prototypes of the new chip, which it calls aneurosynaptic core.Both are built on a standard semiconductor platform with 256neurons,the chip's computational components. RAM units on the chip act as synapses; one of the chips has 262,144 synapses, while the other has 65,536. These networks take after the brain in two key ways, says Dharmendra Modha, the project leader at IBM. The hardware for memory and computation are quite close together (as they are in the brain, where neurons are responsible for both) and the connections between them form, strengthen, and weaken based on learning and experience, just like synapses between neurons.

For more, see A Brainy New Chip Could Make Computers More like Humans by Valerie Ross, August 19, 2011 at 80beats.

From a good article Martha contributed ...

My friends and I [Warren Buffett] have been coddled long enough by a billionaire-friendly Congress. It's time for our government to get serious about shared sacrifice.

See Stop Coddling the Super-Rich by Warren E. Buffett, August 14, 2011 at NYTimes.com.

An airport in France is experimenting with "virtual" boarding agents in a bid to jazz up its terminals with 21st century avatars who always smile, don't need breaks and never go on strike.The pilot project at Paris' Orly airport began last month, and has so far been met with a mix of amusement and surprise by travelers, who frequently try to touch and speak with the strikingly life-like video images that greet them and direct them to their boarding gate.

The images materialize seemingly out of thin air when a boarding agent -- a real live human -- presses a button to signal the start of boarding.

They are actually being rear-projected onto a human shaped silhouette made of plexiglass. Three actual airport boarding agents were filmed in a studio to create the illusion, which the airport hopes will be more eye-catching and easier for passengers to understand than traditional electronic display terminals.

For more, see French Airport Tests 'Virtual' Hologram Boarding Agents by Associated Press, August 18, 2011 at Fox News.

From an article Sarah V. contributed ...

There are two ways of cutting a deficit: raising taxes or reducing spending. Raising taxes means taking money from the rich. Cutting spending means taking money from the poor. Not in all cases of course: some taxation is regressive; some state spending takes money from ordinary citizens and gives it to banks, arms companies, oil barons and farmers. But in most cases the state transfers wealth from rich to poor, while tax cuts shift it from poor to rich.So the rich, in a nominal democracy, have a struggle on their hands. Somehow they must persuade the other 99% to vote against their own interests: to shrink the state, supporting spending cuts rather than tax rises. In the US they appear to be succeeding.

The Tea Party movement mostly consists of people who have been harmed by tax cuts for the rich and spending cuts for the poor and middle. Why would they mobilise against their own welfare? You can understand what is happening in Washington only if you remember what everyone seems to have forgotten: how this movement began.

a group called Americans for Prosperity (AFP) set up a Tea Party Facebook page and started organising Tea Party events. The movement, whose programme is still lavishly supported by AFP, took off from there.So who or what is Americans for Prosperity? It was founded and is funded by Charles and David Koch. They run what they call "the biggest company you've never heard of", and between them they are worth $43bn. Koch Industries is a massive oil, gas, minerals, timber and chemicals company. In the past 15 years the brothers have poured at least $85m into lobby groups arguing for lower taxes for the rich and weaker regulations for industry. The groups and politicians the Kochs fund also lobby to destroy collective bargaining, to stop laws reducing carbon emissions, to stymie healthcare reform and to hobble attempts to control the banks. During the 2010 election cycle, AFP spent $45m supporting its favoured candidates.

But the Kochs' greatest political triumph is the creation of the Tea Party movement. Taki Oldham's film (Astro)Turf Wars shows Tea Party organisers reporting back to David Koch at their 2009 Defending the Dream summit, explaining the events and protests they've started with AFP help. "Five years ago," he tells them, "my brother Charles and I provided the funds to start Americans for Prosperity. It's beyond my wildest dreams how AFP has grown into this enormous organisation."

Are [Tea Party campaigners] stupid? No. They have been misled by another instrument of corporate power: the media. The movement has been relentlessly promoted by Fox News, which belongs to a more familiar billionaire. Like the Kochs, Rupert Murdoch aims to misrepresent the democratic choices we face, in order to persuade us to vote against our own interests and in favour of his.

For more, see Debt Deal: Anger and Deceit Has Led the Us into a Billionaires' Coup by George Monbiot, August 1, 2011 at guardian.co.uk.

Roughly 20% of those seeking financial counseling this year and last cited medical debt as the primary cause of their decision to seek bankruptcy protection, according to CredAbility, an Atlanta-based nonprofit credit counseling agency that serves clients nationally. That's up from about 12 to 13% in the prior two years.

With unemployment persistently high, more people have lost health coverage along with their jobs ....

For more, see Medical Debt Cited More Often in Bankruptcies by Ann Carrns, August 18, 2011 at Bucks.

Nonfinancial businesses are now sitting on close to $2 trillion in liquid assets that could be invested immediately if there was an increase in sales, and banks have $1.5 trillion of excess reserves that could be lent as well.Fiscal policy could raise velocity and growth by getting money moving throughout the economy. But since that is not feasible, the Fed is the only game in town. Joseph Gagnon, a former Fed economist, says that it should immediately increase the money supply by $2 trillion and promise to keep increasing it until the economy has turned around.

But the Fed is already under pressure to tighten monetary policy from its regional bank presidents, three of whom dissented from last week's Fed decision to keep policy steady. They fear that inflation is right around the corner. But as the Harvard economist Kenneth Rogoff has argued, a short burst of inflation would do more to fix the economy's problems than any other thing. One reason is that inflation raises spending by encouraging consumers and businesses to buy things they need immediately because prices will be higher in the future.

The right policy can be debated, but the important thing is for policy makers to stop obsessing about debt and focus instead on raising aggregate demand. As Bill Gross of the investment firm Pimco put it recently:

While our debt crisis is real and promises to grow to Frankenstein proportions in future years, debt is not the disease — it is a symptom. Lack of aggregate demand or, to put it simply, insufficient consumption and investment is the disease.

For more, see It's the Aggregate Demand, Stupid by Bruce Bartlett, August 16, 2011 at Economix.

From an article which Martha contributed which weaves togther several concepts from previous Mind posts, including ...

In their eagerness to chart the human equivalent of the computer's chips and circuits, most psychologists neglected one mundane but essential part of the machine: the power supply. The brain, like the rest of the body, derived energy from glucose, the simple sugar manufactured from all kinds of foods. To establish cause and effect, researchers at Baumeister's lab tried refueling the brain in a series of experiments involving lemonade mixed either with sugar or with a diet sweetener. The sugary lemonade provided a burst of glucose, the effects of which could be observed right away in the lab; the sugarless variety tasted quite similar without providing the same burst of glucose. Again and again, the sugar restored willpower, but the artificial sweetener had no effect. The glucose would at least mitigate the ego depletion and sometimes completely reverse it. The restored willpower improved people's self-control as well as the quality of their decisions: they resisted irrational bias when making choices, and when asked to make financial decisions, they were more likely to choose the better long-term strategy instead of going for a quick payoff.

The discoveries about glucose help explain why dieting is a uniquely difficult test of self-control — and why even people with phenomenally strong willpower in the rest of their lives can have such a hard time losing weight. They start out the day with virtuous intentions, resisting croissants at breakfast and dessert at lunch, but each act of resistance further lowers their willpower. As their willpower weakens late in the day, they need to replenish it. But to resupply that energy, they need to give the body glucose.

For much more, see Do You Suffer from Decision Fatigue? by John Tierney, August 17, 2011 at NYTimes.com.

From The Choices Still to Be Made in the New Debt Deal by Donna Cooper, Seth Hanlon, August 10, 2011 at Center for American Progress.

It's no secret that humans are not entirely rational when it comes to weighing rewards. For example, we might be perfectly happy with how much money we're making — until we find out how much more the guy in the next cubicle is being paid.But a new study suggests that people who regularly practice Buddhist meditation actually process these common social situations differently — and the researchers have the brain scans to prove it.

[In experiments] the [non-miditators] saw increased activity in a brain structure called the anterior insula when they were confronted with an unfair offer — an area linked to the emotion of disgust.But the meditators' brains reacted quite differently, activating brain areas associated with interoception — the representation of the body's internal state. In fact, the researchers found very little overlap in the two groups' neural responses.

[Ulrich Kirk] also informally interviewed many of the meditators after they underwent the brain scans.They reported that the offers did not actually seem unfair, or rather, that ‘difference' doesn't equal unfairness,Kirk says.It was as if the perception of difference incites less reactivity in meditators.

For the experiments and more, see Study: Buddhist Meditation Promotes Rational Thinking by Michael Haederle, August 11, 2011 at Miller-McCune.

Fanned by the financial crisis, a wave of sentencing and parole reforms is gaining force as it sweeps across the United States, reversing a trend oftough on crimepolicies that lasted for decades and drove the nation's incarceration rate to the highest — and most costly — level in the developed world.

Some early results have been dramatic. In 2007, Texas was facing a projected shortfall of about 17,000 inmate beds by 2012. But instead of building and operating new prison space, the State Legislature decided to steer nonviolent offenders into drug treatment and to expand re-entry programs designed to help recently released inmates avoid returning to custody.As a result, the Texas prison system is now operating so far under its capacity that this month it is closing a 1,100-bed facility in Sugar Land — the first time in the state's history that a prison has closed. Texas taxpayers have saved hundreds of millions of dollars, and the changes have coincided with the violent crime rate's dipping to its lowest level in 30 years.

For more, see Trend to Lighten Harsh Sentences Catches on in Conservative States by Charlie Savage, August 12, 2011 at NYTimes.com.

... 90 of Europe's biggest banks hold 4.7 trillion euros ($6.7 trillion) in short-term loans that must be repaid over the next two years. That burden alone is more than half of the combined gross domestic product of the 17 nations that share the euro currency.

Analysts point out that the top French banks report plenty of cash on hand: 150 billion euros in liquidity for BNP Paribas and 105 billion euros for Société Générale, according to a research report by Sanford C. Bernstein & Company. But analysts say unsettled investors are less concerned about the banks' current positions and more focused on fears that their lenders will abandon them if their top-grade collateral is impaired.In fact, most European banks, including France's top institutions, appear to be in much better shape than their counterparts in Ireland and Britain were in 2007 and 2008 when they were forced into the arms of their governments. None of the banks are in the dire straits that pushed Ireland to take over Anglo Irish Bank or Britain to rescue the Royal Bank of Scotland.

The bank troubles now are not about liquidity, but instead solvency,said Mr. Boone, a visiting economist at the London School of Economics.Governments can solve solvency problems through capital injections and loan guarantees — but this just increases the potential liabilities of the government.

For more, see Investors Fret at Costs If Rescues Are Needed by Landon Thomas JR., August 11, 2011 at NYTimes.com.

50% of the U.S.'s income goes to the top 10% of earners,

36% to the top 5%,

21% to the top 1%,

17% to the top 0.5%, and

10% to the top 0.1%.

Share of the nation's income over time by earning bracket (including capital gains) ...

The share of the nation's income earned by the top 0.1% ...

For an interesting table and other charts, see (Not) Spreading the Wealth by June 18, 2011, August 9, 2011 at The Washington Post.

From an article John C. contributed ...

The most telling moment of Thursday's GOP debate ... was when every single GOP candidate on the stage agreed that they would reject a budget deal that was $10 in spending cuts for every $1 in tax increases. Even Fox News's Bret Baier couldn't quite believe what he was seeing. He asked again just to make sure the assembled candidates had understood the question.

The best policy in this debate wasn't the policy most likely to work, or the policy most likely to pass. It was the most orthodox policy. The policy least sullied by compromise. A world in which the GOP will not agree to deficit reduction with a 10:1 split between spending cuts and tax increases is a world where entitlement reform can't happen. It's a world where thesupercommitteefails and the trigger is pulled, and thus a world in which $1 out of every $2 in cuts comes from the Pentagon. It's not a world that fits what many in the GOP consider ideal policy. But it is a world in which none in the GOP need to traverse the treacherous politics of compromise.

For more, see Wonkbook: No Winners in Thursday's Debate, but Many Losers by Ezra Klein, August 12, 2011 at Ezra Klein.

A thin band of antimatter particles called antiprotons enveloping the Earth has been spotted for the first time.The find, described in Astrophysical Journal Letters, confirms theoretical work that predicted the Earth's magnetic field could trap antimatter.

The team says a small number of antiprotons lie between the Van Allen belts of trapped "normal" matter.

The researchers say there may be enough to implement a scheme using antimatter to fuel future spacecraft.

For more, see Antimatter Belt Around Earth Discovered by Pamela Craft, August 7, 2011 at BBC.

Twenty years after voters approved the nation's most restrictive term-limits law, and elected Wilson California's 36th governor, a new study by the nonpartisan, nonprofit Center for Governmental Studies (CGS) concludes the fundamental goals of Proposition 140 have not been met.

For starters, most of those arriving in Sacramento are already politicians, not coming from private industry, but from taxpayer-funded, elected or appointed local government jobs.

Far from returning to the farm, these alleged aspiring sons of Cincinnatus are now less likely to do so ....

More troubling, for those who want term limits to oppose special interests, the impact has been the opposite:to increase lobbyist influence over the policy process.

Inexperienced new legislators rely on lobbyists for policy information when they are unable to obtain information from other members or their staffs,the CGS found, citing a National Conference of State Legislatures study with similar conclusions:Term limits have increased the power of lobbyists over the California Legislature.

For more, see How Term Limits Failed by Jerry Roberts, July 28, 2011 at Santa Barbara Independent.

Here's one financial figure some big U.S. companies would rather keep secret: how much more their chief executive makes than the typical worker.Now a group backed by 81 major companies — including McDonald's, Lowe's, General Dynamics, American Airlines, IBM and General Mills — is lobbying against new rules that would force disclosure of that comparison.

On Wednesday, a House committee approved a bill that would repeal the disclosure requirement.

In 1970, average executive pay at the nation's top companies was 28 times the average worker income, according to the Frydman-Molloy data and numbers provided by Emmanuel Saez at the University of California at Berkeley. By 2005, executive pay had jumped to 158 times that of the average worker.

For more, see Business Group: Public Companies Shouldn't Have to Compare CEO and Worker Pay by Peter Whoriskey, June 24, 2011 at The Washington Post.

... the average income for American taxpayers fell to $54,283 -- a drop of $3,516, or about 6.1%, between 2008 and 2009. Not only that, but the overall number of taxpayers -- that is, individuals or married couples filing with the IRS -- fell by almost two million.

Tax returns filed in 2009 largely speak to the state of the economy in 2008 -- a time when unemployment ballooned, markets dropped precipitously and the economy languished in recession.

For more, see American Millionaires: 1,400 Paid No U.S. Income Taxes in 2009 by Alexander Eichler, August 5, 2011 at The Huffington Post.

On Monday's show, Rush Limbaugh attacked Obama for purposefully ruining the rosy economy he inherited from president Bush.

From Limbaugh Concocts the Unemployment Rate Obama Inherited from Bush by Eric Boehlert, August 9, 2011 at MediaMatters.

You can see a "receipt" for the 2010 Federal taxes you paid at Your 2010 Federal Taxpayer Receipt, at The Whitehouse.

Standard and Poor's press release is at S&P Downgrades U.S. Debt Rating — Press Release, August 5, 2011 at The Wall Street Journal.

In the US ...

From Left vs Right V1.5 by David Mccandless and Stefanie Posavec, July 22, 2011 at Information Is Beautiful.

A bank is paying negative interest ...

Bank of New York Mellon Corp. said Thursday that it will charge its customers a fee to hold cash deposits over $50 million.The bank said it has seen such a large increase in deposits over the last month that it will charge a 0.13% fee to clients with "extraordinary high deposit levels."

Normally, banks pay interest to customers for deposits. But with short-term interest rates near zero, and increased FDIC insurance premiums on deposits, it hurts banks when they hold large amounts of cash on their balance sheets. Deposits are considered a liability because they can be withdrawn at any time. When liabilities go up, banks pay more for FDIC deposit insurance.Geller believes that the fee on deposits could soon trickle down to consumer deposits too. He said the same economic conditions and nervousness are impacting the American people as managers of pension funds.

For more, see Bank of New York Mellon Will Charge Clients to Hold over $50M in Deposits by Pallavi Gogoi, August 4, 2011 at The Huffington Post.

My prediction: There will be a Federal govenment shutdown in the next 18 months.

If you've ever shopped for a home mortgage, you probably recognize — perhaps with a knot of fear in your gut — these two federally mandated pieces of paperwork: the two-page Truth in Lending disclosure, and the three-page Good Faith Estimate form. They are, despite their sweet-sounding names, daunting loan documents for consumers about to make the largest financial commitment of their lives.The government has long required banks to present these papers to potential home buyers to help them grasp the full consequences of loans and all the sneaky fees that go with them. Over the years, the forms have been studied and fought over and adjusted, rarely to the satisfaction of consumer advocates.

The bureau has asked consumers to weigh in on a pair of designs for a revamped two-page form that would combine the Truth in Lending and Good Faith Estimate documents.

The public process the Consumer Financial Protection Bureau is using to now design that information represents a significant break in how government typically shapes such regulation.

The first thing they always do is talk to the industry lawyers, and that tends to warp their thinking,Mierzwinski said.They worry about compliance, not clarity. They worry about bank concerns rather than consumer concerns. And because they're in rooms with lawyers every day of their lives, they don't think like consumers.This campaign suggests, Mierzwinski said, that the bureau has new ideas —

and the new ideas don't just extend to fixing forms, they extend to fixing government.

For more, see Mortgage Loan Documents Getting an Overhaul by Emily Badger, June 7, 2011 at Miller-McCune.

See the last sentence in ...

The two teenagers met inside an ice cream factory through darting glances before roll call, murmured hellos as supervisors looked away and, finally, a phone number folded up and tossed discreetly onto the workroom floor.

This month, a group of men spotted the couple riding together in a car, yanked them into the road and began to interrogate the boy and girl. Why were they together? What right had they? An angry crowd of 300 surged around them, calling them adulterers and demanding that they be stoned to death or hanged.When security forces swooped in and rescued the couple, the mob's anger exploded. They overwhelmed the local police, set fire to cars and stormed a police station six miles from the center of Herat, raising questions about the strength of law in a corner of western Afghanistan and in one of the first cities that has made the formal transition to Afghan-led security.

The riot, which lasted for hours, ended with one man dead, a police station charred and the two teenagers, Halima Mohammedi and her boyfriend, Rafi Mohammed, confined to juvenile prison.

Both say they want to be together, but there are complications. Family members of the man killed in the riot sent word to Ms. Mohammedi that she bears the blame for his death. But they offered her an out: Marry one of their other sons, and her debt would be paid.

For more, see In Afghanistan, Rage at Young Lovers by Jack Healy, July 30, 2011 at NYTimes.com.

This 2007 article provides some perspective on the fact that so many mortgages were subprime -- they didn't deserve to be.

One common assumption about the subprime mortgage crisis is that it revolves around borrowers with sketchy credit who couldn't have bought a home without paying punitively high interest rates. But it turns out that plenty of people with seemingly good credit are also caught in the subprime trap.An analysis for The Wall Street Journal of more than $2.5 trillion in subprime loans made since 2000 shows that as the number of subprime loans mushroomed, an increasing proportion of them went to people with credit scores high enough to often qualify for conventional loans with far better terms.

In 2005, the peak year of the subprime boom, the study says that borrowers with such credit scores got more than half -- 55% -- of all subprime mortgages that were ultimately packaged into securities for sale to investors, as most subprime loans are. The study by First American LoanPerformance, a San Francisco research firm, says the proportion rose even higher by the end of 2006, to 61%. The figure was just 41% in 2000, according to the study. Even a significant number of borrowers with top-notch credit signed up for expensive subprime loans, the firm's analysis found.

For more, see Subprime Debacle Traps Even Very Credit-Worthy by Rick Brooks and Ruth Simon, December 3, 2007 at WSJ.com.

Alright, alright, one more farewell post for Atlantis just because this image is so very amazing. Captured by the crew aboard the International Space Station, the image shows Atlantis's glowing hot re-entry into Earth's atmosphere and the plasma trail it left behind.

For more, see One Last Pic: Atlantis's Glowing Re-Entry, Captured from the ISS by Clay Dillow, July 21, 2011 at Popular Science.

California gets $79 billion a year from the federal government - nearly 40% of what it spends. The money goes to everything from highways to universities.[Emphasis added].So when the federal government sneezes, California catches a cold.

"If we reduce the deficit at the federal level, it's going to increase deficits at the state level," said Vin Weber, a former Republican member of Congress and GOP consultant. "That's not the objective of people, but it's going to happen, and they all know it."

"The state relies heavily on federal funding, for everything from building roads to paying unemployment insurance benefits."

About a third of all [Federal] spending on domestic discretionary programs comes as grants to states, ....

California receives billions of dollars in block grants for education, child care, social services, aging programs and the like ....

For more, see Debt Deal Could Devastate California Budget by Carolyn Lochhead, July 30, 2011 at SFGate.

The compromise to close the state's huge budget gap included cuts to state agencies of all kinds, but none were as deep as those to the state's public colleges and universities. The state's two systems were each cut by $650 million, and they each could lose $100 million more if the state's optimistic revenue expectations do not materialize. For both systems, the $650 million is roughly a 20% cut of operating money from the state.[Emphasis added].

For more, see California Cuts Weigh Heavily on Its Colleges by Jennifer Medina, July 8, 2011 at NYTimes.com.

[Federal tax] revenue has been below 15% of G.D.P. since 2009, and the last time we had three years in a row when revenue as a share of G.D.P. was that low was 1941 to 1943.Revenue has averaged 18% of G.D.P. since 1970 and a little more than that in the postwar era. At a similar stage in previous business cycles, two years past the trough, revenue was considerably higher: 18% of G.D.P. in 1977 after the 1973-75 recession; 17.3% of G.D.P. in 1984 after the 1981-82 recession, and 17.5% of G.D.P. in 1993 after the 1990-91 recession. Revenue was markedly lower, however, at this point after the 2001 recession and was just 16.2% of G.D.P. in 2003.

The reason, of course, is that taxes were cut in 2001, 2002, 2003, 2004 and 2006.

It would have been one thing if the Bush tax cuts had at least bought the country a higher rate of economic growth, even temporarily. They did not. Real G.D.P. growth peaked at just 3.6% in 2004 before fading rapidly. Even before the crisis hit, real G.D.P. was growing less than 2% a year.

By contrast, after the 1982 and 1993 tax increases, growth was much more robust. Real G.D.P. rose 7.2% in 1984 and continued to rise at more than 3% a year for the balance of the 1980s.

Real G.D.P. growth was 4.1% in 1994 despite widespread predictions by opponents of the 1993 tax increase that it would bring on another recession. Real growth averaged 4% for the balance of the 1990s. By contrast, real G.D.P. growth in the nonrecession years of the 2000s averaged just 2.7% a year — barely above the postwar average.

For much more, see Are the Bush Tax Cuts the Root of Our Fiscal Problem? by Bruce Bartlett, July 26, 2011 at Economix.