From a long article which argues that government employee unions should not be allowed to bargain ...

As private-sector unions have withered, public-sector unions have grown dramatically.

The Bureau of Labor Statistics reports that, in 2009, for the first time ever,

more public-sector employees (7.9 million) than private-sector employees (7.4 million) belonged to unions.

Today, unionized workers are more likely to be teachers, librarians, trash collectors, policemen,

or firefighters than they are to be carpenters, electricians, plumbers, auto workers, or coal miners.

In today's public sector, good pay, generous benefits,

and job security make possible a stable middle-class existence for nearly everyone from janitors to jailors.

In the private economy, meanwhile, cutthroat competition, increased income inequality, and layoffs squeeze the middle class.

When it comes to advancing their interests, public-sector unions have significant advantages over traditional unions.

For one thing, using the political process, they can exert far greater influence over their members' employers —

that is, government — than private-sector unions can.

Through their extensive political activity,

these government-workers' unions help elect the very politicians who will act as "management" in their contract negotiations —

in effect handpicking those who will sit across the bargaining table from them,

in a way that workers in a private corporation (like, say, American Airlines or the Washington Post Company) cannot.

Such power led Victor Gotbaum, the leader of District Council 37 of the AFSCME in New York City,

to brag in 1975: "We have the ability, in a sense, to elect our own boss."

Since public-sector unions began to develop in earnest, their importance in political campaigns has grown by leaps and bounds.

Starting from almost nothing in the 1960s,

government-workers' unions now far exceed private-sector unions in political contributions.

According to the Center for Responsive Politics, from 1989 to 2004, the AFSCME was the biggest spender in America,

giving nearly $40 million to candidates in federal elections (98.5% of it to Democrats).

It is important to stress that this was spending on federal elections; the union represents mostly state and local workers.

But given the magnitude of federal contributions to state budgets,

the AFSCME is heavily involved in electioneering to shape Washington's spending in ways that protect public workers and the supply

of government services.

And so over that 15-year period, the AFSCME was willing and able to outspend any other organization in the country.

By contrast, as economist Richard Freeman has written,

"public sector unions can be viewed as using their political power to raise demand for public services,

as well as using their bargaining power to fight for higher wages." The millions spent by public-employee unions on ballot measures

in states like California and Oregon, for instance,

almost always support the options that would lead to higher taxes and more government spending.

The California Teachers Association, for example,

spent $57 million in 2005 to defeat referenda that would have reduced union power and checked government growth.

And the political influence of such massive spending is of course only amplified by the get-out-the-vote efforts of the unions and

their members.

This power of government-workers' unions to increase (and then sustain) levels of employment through the political process helps

explain why, for instance, the city of Buffalo, New York, had the same number of public workers in 2006 as it did in 1950 —

despite having lost half of its population ....

A further important advantage that public-sector unions have over their private-sector counterparts is their relative freedom from

market forces.

In the private sector, the wage demands of union workers cannot exceed a certain threshold: If they do,

they can render their employers uncompetitive, threatening workers' long-term job security.

In the public sector, though, government is the monopoly provider of many services,

eliminating any market pressures that might keep unions' demands in check.

Moreover, unlike in the private sector, contract negotiations in the public sector are usually not highly adversarial;

most government-agency mangers have little personal stake in such negotiations.

Unlike executives accountable to shareholders and corporate boards, government managers generally get paid the same —

and have the same likelihood of keeping their jobs — regardless of whether their operations are run efficiently.

They therefore rarely play hardball with unions like business owners and managers do;

there is little history of "union busting" in government.

Finally,

public-sector unions enjoy a privileged position in relation not only to their private-sector counterparts but also to other

interest groups.

Public-sector unions have automatic access to politicians through the collective-bargaining process,

while other interest groups must fight for such entrée.

Government unions can also more easily mobilize their members for electoral participation than other interest groups can —

since they are able to apply pressure at the workplace and, in many cases,

can even arrange for time off and other benefits to make members' political activism easier.

Furthermore, most interest groups must devote a great deal of time and effort to fundraising;

public-sector unions, on the other hand, enjoy a steady, reliable revenue stream,

as union dues are deducted directly from members' paychecks (often by government,

which drastically reduces the unions' administrative costs).

Taken together,

the intrinsic advantages that public-sector unions enjoy over private-sector advocacy groups (including private-sector unions) have

given organized government laborers enormous power over government at the local, state, and federal levels;

to shape public finances and fiscal policy; and to influence the very spirit of our democracy.

The results, unfortunately, have not always been pretty.

A UNIONIZED GOVERNMENT

The effects of public-sector unionism can be grouped under three broad headings.

The first centers on compensation, which includes wages, pensions, health care,

and other benefits easily valued in monetary terms — the core issues at stake in collective-bargaining negotiations.

The second involves the amount of government employment, or the size of government,

as reflected in the number of workers and in public budgets.

The third involves the productivity and efficiency of government services.

Insofar as unions negotiate detailed work rules,

they share the power to shape the day-to-day responsibilities of public servants —

which influences what government does, and how well it does it.

These are complex matters that are hard for social scientists to measure, and on which scholars disagree.

Nevertheless, the evidence supports a few broad conclusions.

Most economists agree that public-sector unions' political power leads to more government spending.

And recently,

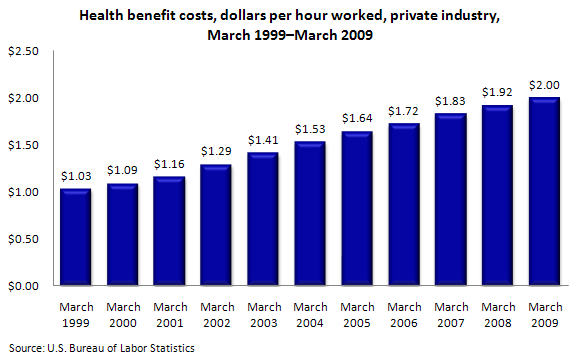

Chris Edwards of the Cato Institute documented how government unionism has abetted growth in public-sector compensation.

Generally speaking, the public sector pays more than the private sector for jobs at the low end of the labor market,

while the private sector pays more for jobs at the high end.

For janitors and secretaries, for instance,

the public sector offers an appreciably better deal than the private economy: According to the Bureau of Labor Statistics,

the average annual salary for the roughly 330,000 office clerks who work in government was almost $27,000 in 2005,

while the 2.7 million in the private sector received an average pay of just under $23,000.

Nationwide, among the 108,000 janitors who work in government, the average salary was $23,700;

the average salary of the 2 million janitors working in the private sector, meanwhile, was $19,800.

For workers with advanced degrees, however,

the public-sector pay scale is likely to be slightly below the private-sector benchmark.

Private-sector economists, for instance, earn an average of $99,000 a year,

compared to the $69,000 earned by their government colleagues.

And accountants in the corporate world earn average annual salaries of $52,000,

compared to $48,000 for their public-sector counterparts.

When all jobs are considered, state and local public-sector workers today earn, on average,

$14 more per hour in total compensation (wages and benefits) than their private-sector counterparts.

The New York Times has reported that public-sector wages and benefits over the past decade have grown twice as fast as those in the

private sector.

These aggregate pay differentials stem partly from the fact that government work tends to be more white-collar,

and that public employees tend to be better educated and more experienced, and to live in urban areas.

Another factor is the hollowing out of the middle of the income distribution in the private sector.

But union influence still plays a major role.

When unions have not been able to secure increases in wages and salaries, they have turned their attention to benefits.

USA Today journalist Dennis Cauchon notes that, since 2002, for every $1-an-hour pay increase,

public employees have gotten $1.17 in new benefits;

private-sector workers, meanwhile, have received just 58 cents in added benefits.

Of special interest to the unions has been health care: Across the nation, 86%

of state- and local-government workers have access to employer-provided health insurance, while only 45%

of private-sector workers do.

In many cases, these plans involve meager contributions from employees, or none at all — in New Jersey, for instance, 88%

of public-school teachers pay nothing toward their insurance premiums.

The unions' other cherished benefit is public-employee pensions.

In California, for example,

state workers often retire at 55 years of age with pensions that exceed what they were paid during most of their working years.

In New York City, firefighters and police officers may retire after 20 years of service at half pay —

which means that, at a time when life expectancy is nearly 80 years,

New York City is paying benefits to 10,000 retired cops who are less than 50 years old.

Those benefits quickly add up: In 2006,

the annual pension benefit for a new retiree averaged just under $73,000 (and the full amount is exempt from state and local taxes).

How, one might ask, were policymakers ever convinced to agree to such generous terms?

As it turns out, many lawmakers found that increasing pensions was very good politics.

They placated unions with future pension commitments, and then turned around, borrowed the money appropriated for the pensions,

and spent it paying for public services in the here and now.

Politicians liked this scheme because they could satisfy the unions,

provide generous public services without raising taxes to pay for them, and even sometimes get around balanced-budget requirements.

For much more, see

The Trouble with Public Sector Unions

by Daniel Disalvo, Fall, 2010

at NationalAffairs.com.