Mostly funny (plus a FOX commentator asking "is NPR an agent somehow of a jihadist inquisition") ...

From NPR Staffing Decision 2010, October 25, 2010, at The Daily Show.

About mind, government, climate, economics, health, politics, science, ..., and a touch of humor.

Mostly funny (plus a FOX commentator asking "is NPR an agent somehow of a jihadist inquisition") ...

From NPR Staffing Decision 2010, October 25, 2010, at The Daily Show.

Iran has imposed new restrictions on 12 university social sciences deemed to be based on Western schools of thought and therefore incompatible with Islamic teachings, state radio reported Sunday.The list includes law, philosophy, management, psychology, political science and the two subjects that appear to cause the most concern among Iran's conservative leadership — women's studies and human rights.

"The content of the current courses in the 12 subjects is not in harmony with religious fundamentals and they are based on Western schools of thought," senior education official Abolfazl Hassani told state radio.

Some two million out of 3.5 million Iranian university students are studying social sciences and humanities, according to government statistics.

For more, see Iran Restricts Social Sciences Seen as 'Western' by Nassar Karimi, October 24, 2010 at Time.

The more propaganda we hear, the less we know ...

After rating hundreds of claims in the 2010 election -- from TV ads, debates, interviews and mailings -- we're giving an overall Truth-O-Meter rating to the campaign.We rate it Barely True.

In a majority of claims checked this fall by PolitiFact and our eight state partners, we found a grain of truth, but it was exaggerated, twisted or distorted. (We define Barely True as a statement containing some element of truth, but it "ignores critical facts that would give a different impression.")

Lately, a growing number of claims haven't even risen to the level of Barely True. In the past two weeks, we've seen a surge of statements so wrong that they've earned False and Pants on Fire ratings.

For more, see We Rate the 2010 Campaign Barely True by Bill Adair, October 27, 2010 at PolitiFact.

In 2005 our National Academies responded to a call from a bipartisan group of senators to recommend 10 actions the federal government could take to enhance science and technology so America could successfully compete in the 21st century. Their response was published in a study, spearheaded by the industrialist Norman Augustine, titled “Rising Above the Gathering Storm: Energizing and Employing America for a Brighter Economic Future.”Charles M. Vest, the former M.I.T. president, worked on the study and noted in a speech recently that

Gathering Storm,together with work by the Council on Competitiveness, led to the America Competes Act of 2007, which increased funding for the basic science research that underlies our industrial economy. Other recommendations, like improving K-12 science education, were not substantively addressed.So, on Sept. 23, the same group released a follow-up report:

Rising Above the Gathering Storm Revisited: Rapidly Approaching Category 5.The subtitle, ‘Rapidly Approaching Category 5,' says it all,noted Vest.The committee's conclusion is that ‘in spite of the efforts of both those in government and the private sector, the outlook for America to compete for quality jobs has further deteriorated over the past five years.'But I thought:

We're number 1!

Here is a little dose of reality about where we actually rank today,says Vest: sixth in global innovation-based competitiveness, but 40th in rate of change over the last decade; 11th among industrialized nations in the fraction of 25- to 34-year-olds who have graduated from high school; 16th in college completion rate; 22nd in broadband Internet access; 24th in life expectancy at birth; 27th among developed nations in the proportion of college students receiving degrees in science or engineering; 48th in quality of K-12 math and science education; and 29th in the number of mobile phones per 100 people.

A dysfunctional political system is one that knows the right answers but can't even discuss them rationally, let alone act on them, and one that devotes vastly more attention to cable TV preachers than to recommendations by its best scientists and engineers.

For much more, see Can't Keep a Bad Idea down by Thomas L. Friedman, October 26, 2010 at The New York Times.

Arnold Schwarzenegger won in 2006 after spending about $30 million.

California GOP gubernatorial nominee Meg Whitman spent almost $23 million in the first 16 days of October, bringing her total to $163 million, according to a campaign finance disclosure filed Thursday.Whitman still trails Democrat Jerry Brown by 8 percentage points, according to a Public Policy Institute of California poll released earlier this week.

Brown spent $14.6 million during the first 16 days of the month, more than half of the $25.3 million his campaign has spent in total.

From Meg Whitman Spending Hits $163m by Andy Barr, October 22, 2010 at Politico.

Trying to teach a machine how to learn by reading the internet seems like a great way to add the background knowledge needed for general artificial intelligence.

Few challenges in computing loom larger than unraveling semantics, understanding the meaning of language. One reason is that the meaning of words and phrases hinges not only on their context, but also on background knowledge that humans learn over years, day after day.Since the start of the year, a team of researchers at Carnegie Mellon University — supported by grants from the Defense Advanced Research Projects Agency and Google, and tapping into a research supercomputing cluster provided by Yahoo — has been fine-tuning a computer system that is trying to master semantics by learning more like a human. Its beating hardware heart is a sleek, silver-gray computer — calculating 24 hours a day, seven days a week — that resides in a basement computer center at the university, in Pittsburgh. The computer was primed by the researchers with some basic knowledge in various categories and set loose on the Web with a mission to teach itself.

For more, see Aiming to Learn as We Do, a Machine Teaches Itself by Steve Lohr, October 4, 2010 at The New York Times. Thank you, Martha.

Some tidbits from good, long article on out debt ...

The largest holders of Treasury securities by far are foreign institutions, which own nearly 50% of all Treasury securities outstanding (despite acquiring less than 20% at auction). The next largest holder of debt is the Federal Reserve, with 9.4% of all Treasury securities, followed by individual Americans, who own 9% of the total; mutual funds, which own 7.8%; and state and local governments, which own about 6.5%.Foreigners hold about $4 trillion in Treasury securities today, and roughly $2.9 trillion of that amount is owned by so-called foreign official investors: central banks and finance ministries that build reserves of foreign currencies to support their exchange rates or monetary systems (as discussed below). Most of them use the U.S. dollar for this purpose, which makes it the global reserve currency of choice. At the end of 2009, the dollar accounted for 62% of declared official foreign-exchange reserves, up from 59% in 1995. It is striking to note that, even though the euro was introduced in 1999 to create a second global reserve currency, the euro share of foreign-exchange reserves at the end of 2009 — 27% — was roughly equal to the percentage of reserves in 1995 denominated in the old currencies of those European countries that eventually adopted the euro (such as the Deutschemark and French franc).

As of April, the largest foreign holders of Treasury securities were the People's Republic of China ($900 billion, or 11% of the entire Treasury market), Japan ($796 billion, or 9.5%), the combined OPEC nations ($239 billion, or 3.5%), Brazil ($164 billion, or 2%), and Russia ($113 billion, or 1.4%). In addition, a combined $474 billion (nearly 6% of Treasury securities outstanding) were held in accounts located in the United Kingdom and in Caribbean and other North American banking centers (the Bahamas, Bermuda, the Cayman Islands, the Netherlands Antilles, and Panama).

... discussions of the national debt too often overlook the fact that, in recent decades, private indebtedness in America has been growing as quickly as public indebtedness. Even as the federal debt reaches and exceeds post-war records as a share of the economy, it remains well within historical bounds as a share of the total U.S. credit market. An $8.3 trillion federal debt accounts for just 16% of the total value of all American credit-market obligations outstanding — that is, of all public and private debt in America. This is actually slightly less than the federal debt's average share of the combined stock of public and private debt since 1970 (16.2%).The stability of this ratio in the face of burgeoning federal borrowing is a reflection of the dramatic increase in the private-sector debt-to-GDP ratio. In 1970, total non-federal debt outstanding in America was equal to 125% of GDP. Today, it is roughly 300% of GDP. The astonishing growth of household debt (from 44% to 93% of GDP) and financial-sector debt (from 12% to 103% of GDP) means that a much larger share of national income has already been pledged to service debt obligations than has generally been the case in American history.

In the first quarter of 2009, total economy-wide borrowing was negative — meaning more money was being repaid than borrowed — for the first time since the Federal Reserve began tracking such data in 1946. It has remained negative in the four quarters since.

This brings us back to the two different ways of reading today's economic data. In the past two years, the federal government has been able to sell its debt on extremely favorable terms (in part because commercial borrowing declined dramatically, leaving investors with fewer options and so making federal debt more attractive). But can its string of luck continue? The answer depends on one's understanding of what exactly is happening to our economy in the aftermath of the financial crisis of 2008. This is why there has been such intense disagreement among experts about the future of the federal debt:

The data can accommodate two stories.The first is that the American economy suffers from excess capacity resulting from a temporary decline in aggregate demand. In this view, the large private-sector financial surplus of the moment (that is, the fact that businesses are saving and repaying more than they are spending and borrowing) reflects a weakness in consumer spending and business investment in the real economy. Deficit-financed government spending — putting money into the hands of citizens to spur private consumption, or making direct government purchases — is all that is preventing the economy from falling into a deflationary spiral caused by the liquidation of assets (which is the necessary counterpart to the private sector's effort to reduce outstanding debt).

The second view is that the private-sector financial surplus is driven by consumer and producer expectations about the future tax implications of government borrowing. Named after the classical economist David Ricardo and popularized by Harvard economist Robert Barro, this "Ricardian" theory (in its various forms) argues that the private sector responds to increases in public-sector borrowing by increasing its estimates of future taxation, therefore lowering its estimates of future disposable income and reducing current spending. Under this theory, the private-sector surpluses come from the increased savings caused by these revised expectations. Indeed, if one is ever likely to see Ricardian effects manifest themselves, it would be in the wake of a sudden 50% increase in the debt-to-GDP ratio. And, as with the first view, the data above fit this story perfectly.

This debate is also mirrored in the dispute about the impact of debt-financed stimulus over the past two years. If private-sector surpluses are a response not only to reduced demand, but also to public-sector debt growth, then borrowing huge sums of money to fund a stimulus bill could well end up making things worse, or at least fail to make them much better. The government's financial position could end up deteriorating without a corresponding boost to the economy.

Between 1936 and 1938, the government pursued a contractionary fiscal and monetary policy that closed a 5.4%-of-GDP budget deficit within two years. The result was a fall in output and a spike in unemployment — contributing to the Great Depression's "second dip." Today's policymakers certainly have reason to fear repeating this mistake.But economists on the other side of the argument are motivated by concerns just as real. Their worry is not that the United States would default on its debt: The government borrows in a currency that it prints, and it is difficult to conceive of a situation in which it would be more advantageous for the United States to renounce obligations than to print whatever amount of dollars would be necessary to meet them. The real problem is that bond-market investors are not oblivious to this flexibility. When it appears likely that a country will print money to inflate away unsustainable debt burdens, interest rates rise to incorporate an inflation risk premium — thus increasing the burden on the government and on private borrowers. The danger, then, is that excessive borrowing will bring investors' hunger for Treasury securities to an end, causing a spike in interest rates that could crush the American economy and send it into a debt spiral we would find very difficult to escape.

For much more, see Managing the Federal Debt by Jason Thomas, Fall, 2010 at NationalAffairs.com.

A pretty, 9:00 video with a nice soundtrack ...

From How Ink Is Made by PrintingInkCompany, June 17, 2010 at YouTube.com. Thank you, Martha.

Prop. 13 was sold to California as a way to keep people in their homes,[Phil Ting] said in Santa Barbara last week.But today, what has happened is that its primary beneficiaries really aren't homeowners; they're commercial property owners and corporations.

Citing state revenue studies, Ting estimates that assessing commercial property at market rate, instead of older, Prop. 13-enabled values, would generate an additional $7.5 billion in tax revenue — a big chunk of recent budget shortfalls.Before Prop. 13, commercial property owners in San Francisco paid about 60 percent of the city's property taxes, and homeowners about 40 percent; three decades later, the ratio has been reversed, a trend also seen elsewhere.

For more, see Third-Rail Man by Jerry Roberts, October 14, 2010 at The Santa Barbara Independent.

Another reason to beware of using unencrypted wireless networks with private information ...

When logging into a website you usually start by submitting your username and password. The server then checks to see if an account matching this information exists and if so, replies back to you with a "cookie" which is used by your browser for all subsequent requests.[Emphasis added].It's extremely common for websites to protect your password by encrypting the initial login, but surprisingly uncommon for websites to encrypt everything else. This leaves the cookie (and the user) vulnerable. HTTP session hijacking (sometimes called "sidejacking") is when an attacker gets a hold of a user's cookie, allowing them to do anything the user can do on a particular website. On an open wireless network, cookies are basically shouted through the air, making these attacks extremely easy.

This is a widely known problem that has been talked about to death, yet very popular websites continue to fail at protecting their users. The only effective fix for this problem is full end-to-end encryption, known on the web as HTTPS or SSL. Facebook is constantly rolling out new "privacy" features in an endless attempt to quell the screams of unhappy users, but what's the point when someone can just take over an account entirely? Twitter forced all third party developers to use OAuth then immediately released (and promoted) a new version of their insecure website. When it comes to user privacy, SSL is the elephant in the room.

Today at Toorcon 12 I announced the release of Firesheep, a Firefox extension designed to demonstrate just how serious this problem is.

For more, see Firesheep by Eric Butler, October, 2010 at {codebutler}.

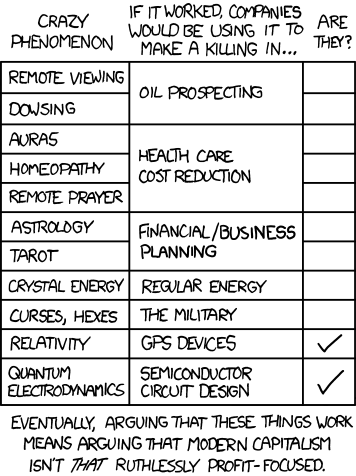

From The Economic Argument October 21, 2010 at xkcd.

Regarding the relationship of Obama and the Republicans if they do well in the election ...

From my seat, I was looking directly at the large photo mural of former senator Dole and his frequent partner, Rep. Gerald Ford of Michigan, the House minority leader.One of them -- Ford -- achieved the presidency only briefly, when Richard Nixon was forced to resign. The other -- Dole -- failed each time he ran. But no one regards them as political failures, because they realized that victory is counted in more than vote totals. They won the ultimate tests of character for two reasons. They did not sacrifice their political principles. And they acknowledged that they shared the responsibility for making this system of government work.

It helped that they came to Washington as young military veterans, survivors of a war against an implacable enemy. They knew the difference between the Nazis, who were truly evil, and the Democrats, who were simply fellow Americans with different political beliefs.

For Obama and the Republicans to establish a productive post-election atmosphere, it may require nothing more than the recapture of that wisdom of their political forebears. Behave as if you are veterans, and today's political disputes will recede to their proper size.

For more, see Dole-Ford Era Offers Model for Obama-GOP Cooperation by David S. Broder, October 21, 2010 at The Washington Post.

Rachael Maddow lists some of the many unremarked upon, bigoted statements by candidates on the campaign trail this year starting at 5:30 in this 14:50 video ...

From Race-Baiting Resurrected: The GOP's Southern Strategy Rises Again (Part 1) and (Part 2), October 20, 2010 at YouTube ,

Newly published research confirms and expands upon an insight first revealed in the 1950s: If confidence in one's core tenets becomes shaky, a common response is to proselytize all the more vigorously.The apparent reason, according to Northwestern University researchers David Gal and Derek Rucker, is that advocacy on behalf of one's beliefs helps banish any uncomfortable lack of certainty.

Although it is natural to assume that a persistent and enthusiastic advocate of a belief is brimming with confidence,they write in the journal Psychological Science,the advocacy might in fact signal that the individual is boiling over with doubt.

For more, see Shouts Banish Doubts by Tom Jacobs, October 15, 2010 at Miller-McCune.

There are some pictures on the Drudge Report. I'm gonna hold them up here to the Dittocam. I've got too many things to do here, but, folks, these pictures, they look demonic. And I don't say this lightly. There are a couple pictures, and the eyes, I'm not saying anything here, but just look. It is strange that these pictures would be released. Snerdley is looking at them and ... see what I'm talking about? It's very, very, very strange. An American president has never had facial expressions like this. At least we've never seen photos of an American president with facial expressions like this.

From Helpless Liberals Watch as Obama Switches from Messiah to Demon by Rush, October 18, 2010 at The Rush Limbaugh Show.

Newly published research suggests senior citizens have a strong unconscious incentive to embrace culturally conservative values: Turning to the right apparently bolsters their self-esteem.

The researchers found growing older was associated with lower levels of self-esteem among those on the liberal side of the scale. But conservatives were spared that decline, leading them to conclude thatconservatism buffers the negative effect of age on self-esteem.Van Hiel and Brebels note this confirms the results of their 2009 study, which found that for the elderly, an authoritarian attitude appears to buffer the harsh effect of negative life events on mental distress.

Right-wing beliefs are good for old people,they write.Conservatism predicts healthy self-esteem above and beyond narcissism among the oldest.Why would this be? Van Hiel and Brebels argue that old age is a time to take stock of your life and attempt to find meaning. For most, this means looking back at your experiences and accomplishments in the context of your social environment. A social-conservative belief system, which values your culture or society above others, would elevate your own personal status, thus propping up your self-esteem.

Ego-integrated individuals have a strong sense of being part of a given culture and tradition that is rooted in the past and should be preserved in the future,they write.Hence, adherence to culture and traditions might be considered a means of granting significance to oneself as a person.The down side of this, of course, is that

people favoring their own group tend to derogate out-groups and to reject everyone who threatens their world view,the researchers write. This results in higher levels of prejudice among the elderly — a phenomenon widely noted in the U.S., but usually ascribed to a reduced ability to repress implicit biases, including those acquired during their formative years in the pre-Civil Rights era.

For more, see For Elderly, Conservative Beliefs Buffer Self-Esteem by Tom Jacobs, October 7, 2010 at Miller-McCune.

The vast majority of campaign spending is done by candidates and political parties. Over the past year, the Democrats, most of whom are incumbents, have been raising and spending far more than the Republicans.According to the Center for Responsive Politics, Democrats in the most competitive House races have raised an average of 47 percent more than Republicans. They have spent 66 percent more, and have about 53 percent more in their war chests. According to the Wesleyan Media Project, between Sept. 1 and Oct. 7, Democrats running for the House and the Senate spent $1.50 on advertising for every $1 spent by Republicans.

The most alarmed coverage concerns the skyrocketing spending of independent groups. It is true that Republicans have an edge when it comes to outside expenditures. This year, for example, the United States Chamber of Commerce is spending $22 million for Republicans, while the Service Employees International Union is spending about $14 million for Democrats.But independent spending is about only a tenth of spending by candidates and parties. Democrats have a healthy fear of Karl Rove, born out of experience, but there is no way the $13 million he influences through the group American Crossroads is going to reshape an election in which the two parties are spending something like $1.4 billion collectively.

Political scientists have tried to measure the effectiveness of campaign spending using a variety of methodologies. There is no consensus in the field. One large group of studies finds that spending by incumbents makes no difference whatsoever, but spending by challengers helps them get established. Another group finds that neither incumbent nor challenger spending makes a difference. Another group finds that both kinds of spending have some impact.

For more, see Don't Follow the Money by David Brooks, October 18, 2010 at The New York Times.

Pay on Wall Street is on pace to break a record high for a second consecutive year, according to a study conducted by The Wall Street Journal.

About three dozen of the top publicly held securities and investment-services firms—which include banks, investment banks, hedge funds, money-management firms and securities exchanges—are set to pay $144 billion in compensation and benefits this year, a 4% increase from the $139 billion paid out in 2009, according to the survey. Compensation was expected to rise at 26 of the 35 firms.

The data showed that revenue was expected to rise at 29 of the 35 firms surveyed, but at a slower pace than pay. Wall Street revenue is expected to rise 3%, to $448 billion from $433 billion, despite a slowdown in some high-profile activities like stock and bond trading.

Overall, Wall Street is expected to pay 32.1% of its revenue to employees, the same as last year, but below the 36% in 2007. Profits, which were depressed by losses in the past two years, have bounced back from the 2008 crisis. But the estimated 2010 profit of $61.3 billion for the firms surveyed still falls about 20% short from the record $82 billion in 2006. Over that same period, compensation across the firms in the survey increased 23%.

For more, see Wall Street Pay: A Record $144 Billion by Liz Rappaport, Aaron Lucchetti and Stephen Grocer, October 11, 2010 at The Wall Street Journal.

You're filming a sports game. An argument breaks out between players, and you zoom in to get a closeup of the action. The crowd goes wild, shouting and booing. Now, you zoom the audio in to hear what the players are saying to each other, despite the din. Impossible? Not with Squarehead's Audioscope.Squarehead's new system is like bullet-time for sound. 325 microphones sit in a carbon-fiber disk above the stadium, and a wide-angle camera looks down on the scene from the center of this disk. All the operator has to do is pinpoint a spot on the court or field using the screen, and the Audioscope works out how far that spot is from each of the mics, corrects for delay and then synchronizes the audio from all 315 of them. The result is a microphone that can pick out the pop of a bubblegum bubble in the middle of a basketball game, as you can see in this video.

For more including a demo, see Super-Microphone Picks Out Single Voice in a Crowded Stadium by Charlie Sorrel, October 6, 2010 at Wired.com.

Decades ago, when the federal and state governments were much smaller, they had the means to undertake gigantic new projects, like the Interstate Highway System and the space program. But now, when governments are bigger, they don't.The answer is what Jonathan Rauch of the National Journal once called demosclerosis. Over the past few decades, governments have become entwined in a series of arrangements that drain money from productive uses and direct it toward unproductive ones.

New Jersey can't afford to build its tunnel, but benefits packages for the state's employees are 41 percent more expensive than those offered by the average Fortune 500 company. These benefits costs are rising by 16 percent a year.

New York City has to strain to finance its schools but must support 10,000 former cops who have retired before age 50.

California can't afford new water projects, but state cops often receive 90 percent of their salaries when they retire at 50. The average corrections officer there makes $70,000 a year in base salary and $100,000 with overtime (California spends more on its prison system than on its schools).

... nationally, state and local workers earn on average $14 more per hour in wages and benefits than their private sector counterparts. A city like Buffalo has as many public workers as it did in 1950, even though it has lost half its population.

... public sector unions can use political power to increase demand for their product. DiSalvo notes that between 1989 ad 2004, the American Federation of State, County and Municipal Employees was the biggest spender in American politics, giving $40 million to federal candidates. The largest impact is on low-turnout local elections. The California prison guard union recently sent a signal by spending $200,000 to defeat a state assemblyman who had tried to reduce costs.In states across the country, elected leaders raise state employee salaries in the fat years and then are careful to placate the unions by raising future pension benefits in the lean ones.

For much more, see The Paralysis of the State by David Brooks, October 12, 2010 at The New York Times.

When British Foreign Secretary William Hague visited the U.S. last week, he placed combating climate change near the very top of the world's To Do list."Climate change is perhaps the 21st century's biggest foreign-policy challenge," Hague declared in a New York City speech. "An effective response to climate change underpins our security and prosperity."

William Hague is not a holdover from the left-leaning Labor Government that British voters ousted last spring. He's not even from the centrist Liberal Democrats who are governing in a coalition with the Conservative Party of Prime Minister David Cameron. Hague is one of Cameron's predecessors as Conservative Party leader.His strong words make it easier to recognize that Republicans in this country are coalescing around a uniquely dismissive position on climate change. The GOP is stampeding toward an absolutist rejection of climate science that appears unmatched among major political parties around the globe, even conservative ones.

For more, see GOP Gives Climate Science a Cold Shoulder by Ronald Brownstein, October 9, 2010 at National Journal Magazine.

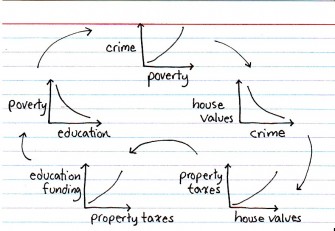

From Why Zip Codes Have Connotations by Jessica Hagy, October 11, 2010 at Indexed.

Here's the narrative you hear everywhere: President Obama has presided over a huge expansion of government, but unemployment has remained high. And this proves that government spending can't create jobs.Here's what you need to know: The whole story is a myth.

The total number of government workers in America has been falling, not rising, under Mr. Obama. A small increase in federal employment was swamped by sharp declines at the state and local level — most notably, by layoffs of schoolteachers. Total government payrolls have fallen by more than 350,000 since January 2009.Now, direct employment isn't a perfect measure of the government's size, since the government also employs workers indirectly when it buys goods and services from the private sector. And government purchases of goods and services have gone up. But adjusted for inflation, they rose only 3 percent over the last two years — a pace slower than that of the previous two years, and slower than the economy's normal rate of growth.

... the stimulus wasn't actually all that big compared with the size of the economy. Furthermore, it wasn't mainly focused on increasing government spending. Of the roughly $600 billion cost of the Recovery Act in 2009 and 2010, more than 40 percent came from tax cuts, while another large chunk consisted of aid to state and local governments. Only the remainder involved direct federal spending.

For more, see Hey, Small Spender by Paul Krugman, October 10, 2010 at The New York Times.

A rare Japanese flower named Paris japonica sports an astonishing 149 billion base pairs, making it 50 times the size of a human genome—and the largest genome ever found. ... The genome of the new record-holder ... would be taller than Big Ben if stretched out end to end.[Emphasis added].

From Scienceshot: Biggest Genome Ever by Elizabeth Pennisi, October 7, 2010 at Science/AAAS.

A securities arbitration panel awarded Mr. Hagman and his wife Maj, 82, a big victory against Citigroup, which had overseen some of the couple's investment accounts. The three arbitrators who heard the case ordered Citigroup to pay the Hagmans $1.1 million in compensatory damages — slightly less than the $1.345 million they had requested — as well as $439,000 in legal fees.But the kicker was the punitive damages award in the case, which accused Citigroup's brokerage unit, Smith Barney, of fraud, breach of fiduciary duty and failure to supervise the broker overseeing the Hagmans' funds. The panel ordered Citigroup to pay $10 million to charities chosen by Mr. Hagman.

So here's what happened to the Hagmans: In 2005, they moved their account from a registered investment adviser to Lisa Ann Detanna, a broker at what is now Morgan Stanley Smith Barney. (When the couple first invested with Smith Barney, Citigroup still owned it; Citigroup sold a controlling stake in the brokerage to Morgan Stanley in 2009.)According to documents produced in the Hagmans' case, Ms. Detanna quickly began upending the couple's portfolio, taking it from a conservative blend of 25 percent stocks and 75 percent fixed income and cash to the opposite: 75 percent stocks and the rest cash and bonds.

Never mind that when the Hagmans first sat down with Ms. Detanna, they told her they needed income-producing investments that would preserve their principal, according to the documents.

Ms. Detanna also sold Mr. Hagman a $4 million life insurance policy that required onerous annual premium payments of $168,000.

A broker who generates significant commissions for her firm, Ms. Detanna was named in June by Barron's as one of the top 100 Women Financial Advisers in America.[Emphasis added].

A look at Ms. Detanna's full regulatory record, however, shows nine customer complaints in addition to Mr. Hagman's between 2000 and 2010. Of these 10 complaints, four resulted in awards or settlements, four were dismissed, one was withdrawn and one is pending. Regardless of their disposition, the sheer number of complaints should have raised flags for Ms. Detanna's manager if he had followed his firm's compliance rules, Mr. Aidikoff told the arbitrators.

For more, see It's Not Nice to Mess with J.R. by Gretchen Morgenson, October 9, 2010 at The New York Times.

The top row shows the actual distribution of wealth in America. The richest 20 percent, represented by that blue line, has about 85 percent of the wealth. The next richest 20 percent, represented by that red line, has about 10 percent of the wealth. And the remaining three-fifths of America shares a tiny sliver of the country's wealth.Below that, the "Estimated" rows show how different groups think wealth is distributed. As you can see, in people's misinformed minds things are much more equitable.

For more, see Americans Are Horribly Misinformed About Who Has Money by Andrew Price, September 28, 2010 at Good.

The Federal Deposit Insurance Corp. has authorized lawsuits against more than 50 executives at failed banks across the country in an attempt to recover more than $1 billion of the agency's losses during the credit crisis.More than 50 bank officers and directors were negligent, committed fraud or otherwise breached their duties and are, therefore, legally liable, the FDIC concluded after lengthy investigations into the first wave of bank failures.

"These investigations are now beginning to produce results, and we anticipate that many more will be authorized," FDIC Chairman Sheila C. Bair said in a statement Friday evening. "As a matter of policy, the FDIC believes strongly in accountability for directors and officers whose personal misconduct led to a bank's failure."

For more, see FDIC Prepares to Sue More than 50 Bank Officials to Recover $1 Billion in Losses by Peter Whoriskey, October 8, 2010 at The Washington Post.

Last August, Education Secretary Arne Duncan said that our students have "stagnated educationally." The College Board recently put this into global perspective when it reported that we've dropped from 1st to 12th place in the percentage of people between the ages of 25 to 34 who have a college degree. America is now in danger of producing a new generation that will be less educated than their parents.Clearly it's not for any lack of money. Over the past three decades, we've nearly doubled spending on K-12 education in real terms. So President Obama was absolutely right to declare the other day that "we can't spend our way out of this problem." Which begs the question: How can we spend so much with so little to show for it?

The Los Angeles Times just gave us an excellent example of this kind of transparency when it published a database of about 6,000 third- through fifth-grade teachers ranked by their effectiveness in raising student test scores. [See Education: Who's Teaching L.A.'S Kids?]. If you are a mom with a son or daughter in one of these classrooms, you know this information is vital. Unfortunately, it's the kind of information that seldom sees the light of day.The reason is that the adults who are doing well by this system don't want it out there. The local teachers union, for example, blasted the Times for what it called "the height of journalistic irresponsibility" for bringing this material to the public.

We all know that good schools begin with good teachers. We also know there are many heroic teachers. Unfortunately, our system is set up to protect bad teachers rather than reward good teachers.In the existing system, we have incentives for almost everything unrelated to performance (seniority, tenure, etc.) and zero incentive for adapting new technologies that could help learning inside and outside the classroom. On top of it all, we have chancellors, superintendents and principals who can't hire and fire based on performance.

According to one study by McKinsey, if we had closed the gap in educational performance between ourselves and nations such as Finland and Korea, our GDP would have been as much as 16% higher in 2008.

For more, see

If Schools Were like American Idol

...

by Rupert Murdoch, October 8, 2010 at FoxNews.com.

How can candidates make these claims?

Also, how could Michael Blumenthal think his false claims about him service in Vietnam wouldn't be found out?

From

Delusional Secret Agent

Candidates,

October 4, 2010 at Real Clear Politics.

The Erie Canal. Hoover Dam. The Interstate Highway System. Visionary public projects are part of the American tradition, and have been a major driver of our economic development.And right now, by any rational calculation, would be an especially good time to improve the nation's infrastructure. We have the need: our roads, our rail lines, our water and sewer systems are antiquated and increasingly inadequate. We have the resources: a million-and-a-half construction workers are sitting idle, and putting them to work would help the economy as a whole recover from its slump. And the price is right: with interest rates on federal debt at near-record lows, there has never been a better time to borrow for long-term investment.

But American politics these days is anything but rational. Republicans bitterly opposed even the modest infrastructure spending contained in the Obama stimulus plan. And, on Thursday, Chris Christie, the governor of New Jersey, canceled America's most important current public works project, the long-planned and much-needed second rail tunnel under the Hudson River.

So here's how you should think about the decision to kill the tunnel: It's a terrible thing in itself, but, beyond that, it's a perfect symbol of how America has lost its way. By refusing to pay for essential investment, politicians are both perpetuating unemployment and sacrificing long-run growth. And why not? After all, this seems to be a winning electoral strategy. All vision of a better future seems to have been lost, replaced with a refusal to look beyond the narrowest, most shortsighted notion of self-interest.

For more, see The End of the Tunnel by Paul Krugman, October 7, 2010 at The New York Times.

More amazing stuff -- not the result but how they got it ....

Chill them enough and some atoms creep up walls or stay still while the bowl they sit in rotates, thanks to a quantum effect called superfluidity. Now molecules have got in on the act.Superfluidity is a bizarre consequence of quantum mechanics. Cool helium atoms close to absolute zero and they start behaving as a single quantum object rather than a group of individual atoms. At this temperature, the friction that normally exists between atoms, and between atoms and other objects, vanishes, creating what is known as a superfluid.

To see if molecules could be made superfluid, Robert McKellar of the National Research Council of Canada in Ottawa and colleagues turned to hydrogen, which exists as pairs of atoms. The team created a compressed mixture of hydrogen and carbon dioxide gas and shot it through a nozzle at supersonic speeds. Once released, the molecules spread apart, cooling and arranging themselves so that each CO2 molecule sat at the centre of a cluster of up to 20 hydrogens.

To test for superfluidity, the team shone an infrared laser at the clusters at wavelengths that CO2, but not hydrogen, can absorb. This set only the CO2 molecules vibrating. Under normal conditions this movement would be slowed down due to friction between the moving CO2 molecules and the surrounding hydrogen. But the researchers found that for clusters of 12 hydrogen molecules, the hydrogen barely impeded the motion of the CO2.

They conclude that these hydrogen clusters are 85 per cent superfluid ....

From First Frictionless Superfluid Created by Kate Mcalpine, October 7, 2010 at NewScientist.

The U.S. government can save more than $1 trillion over the next 10 years by consolidating its IT infrastructure, reducing its energy use and moving to more Web-based citizen services, a group of tech CEOs said in a report released Wednesday....

The Technology CEO Council's report, delivered to President Barack Obama's National Commission on Fiscal Responsibility and Reform, also recommends that the U.S. government streamline its supply chains and move agencies to shared services for mission-support activities.

For more, see Tech CEOs Tell US Gov't How to Cut $1 Trillion from Deficit by Grant Gross, October 6, 2010 at Network World.

A month ago, with much fanfare and relief, President Obama announced that American involvement in Iraq was entering a post-military phase. "Our dedicated civilians -- diplomats, aid workers and advisers -- are moving into the lead to support Iraq," the president said. The State Department would begin taking over training and capacity-building roles previously performed by the Defense Department, in preparation for the departure of all American troops by the end of next year. This phase of the Iraq war was dubbed "New Dawn."Congress has responded to this strategy by cutting funds for civilian efforts in Iraq in ways that may undermine hard-won achievements and endanger American lives. Resources were reduced in the 2010 supplemental spending bill and slashed by the Senate Appropriations Committee in the 2011 budget. This week, Defense Secretary Robert Gates -- in a rare instance of one Cabinet secretary fighting for another department's funding -- responded: "The Congress took a huge whack at the budget the State Department submitted for this process of transition. And it is one of these cases where, having invested an enormous amount of money [in the war], we are now arguing about a tiny amount of money, in terms of bringing this to a successful conclusion."

For more, see Pound-Foolish on National Security by Michael Gerson, October 1, 2010 at The Washington Post.

A few of the many, many stats in Americans Spending More Time Following the News September 12, 2010 at The Pew Research Center for the People and the Press.

The political extremes most like to get information from sources which have their point of view (41% of conservative Republicans and 33% of liberal Democrats) ...

By age ...

Change over time ...

Now ...

The NY Times has one of the most liberal audiences. Maybe it has something to do with people in New York being more liberal than in most states.

No surprises ...

Sorry, but some of the shows you don't agree with have more educated, wealthier audiences than average (regardless of whoever you are).

in the GOP's zeal to repeal a bill it considers a deficit-increasing nightmare, Republicans are focusing their fire on the parts they should like: The cost controls.On July 27, Sen. Jon Cornyn (R-Tex.) introduced the Health Care Bureaucrats Elimination Act, co-sponsored by Sens. Orrin G. Hatch (R-Utah), Jon Kyl (R-Ariz.), Pat Roberts (R-Kan.) and Tom Coburn (R-Okla.). The legislation doesn't seek to repeal health-care reform (though many Republicans would also like to do that). Instead, it takes aim at perhaps its most promising cost control: the Independent Payment Advisory Board.

[It will be composed of] 15 presidential appointees, each confirmed by the Senate. They'll be drawn from the health-care industry, academia, think tanks and consumer groups. Their reform proposals will have to pass through Congress, but they will have some advantages: If Congress doesn't act, their recommendations go into effect. If Congress says no but the president vetoes Congress and the veto isn't overturned, their recommendations go into effect. If Congress wants to change their recommendations in a way that'll save less money, it will need a three-fifths majority. Oh, and no filibusters allowed.The hope is that this will free Congress to permit cuts by making it easier for them to dodge the blame. "Putting the knife in someone else's hand will be a relief," says Robert Reischauer, director of the Urban Institute and a former director of the Congressional Budget Office. "It will allow Congress to rant against the cuts without actually stopping them."

Republicans have zeroed in on the board as a soft target in their campaign to gut the health-care reform bill. "In true fashion of Obama- Reid-Pelosi hubris," Cornyn said, "the IPAB is the definition of a government takeover." A government takeover of . . . Medicare?Putting aside the metaphysics of the government taking over a government program, Cornyn makes two arguments, and they show the difficulty Republicans are having opposing health-care reform without opposing fiscal responsibility and much-needed deficit reduction.

One of his arguments is that IPAB would take these decisions away from Congress, which is more accountable to voters (and thus hasn't been able to make any of these decisions). "America's seniors deserve the ability to hold elected officials accountable for the decisions that affect their Medicare," he said.

Cornyn knows this, and so his other argument is that Congress buckled before lobbyists and that IPAB doesn't go far enough. "Special-interest groups cut deals with Democrats to specifically exempt hospitals, 28 percent of Medicare's budget, from the IPAB's ax," his statement points out.

For more, see GOP Should Rethink Opposition to Health Care's Cost-Control Board by Ezra Klein, August 15, 2010 at The Washington Post.

Seven months after the quake he still has a concern about whether 0.5% of the allocated amount will be wasted. Why hurry?

From Tom Coburn: International A**Hole of Mystery, September 30, 2010 at The Daily Show.

What irony. The MBA apparently walked away from their own mortgage.

Like millions of American households, the Mortgage Bankers Association found itself stuck with real estate whose market value has plunged far below the amount it owed its lenders.[Emphasis added].But the trade group for mortgage lenders is refusing to say exactly how it extracted itself from that predicament.

On Friday, CoStar Group Inc., a provider of commercial real estate data, announced that it had agreed to buy the MBA's 10-story headquarters building in Washington, D.C., for $41.3 million. The price is far below the $79 million the trade group says it paid for the glass-walled building in 2007, while it was still under construction. The price also is far below the $75 million financing that the MBA received from a group of banks led by PNC Financial Services Group Inc. to finance the purchase.

John Courson, chief executive officer of the trade group, declined in an interview Saturday to say whether the MBA would pay off the full loan amount. "We're not going to discuss the financing," he said. A spokeswoman for the MBA added that the MBA has reached "an agreement with all relevant parties" regarding the outstanding amount on that loan but declined to provide any details.

In an interview late last year, Mr. Courson said he believed mortgage borrowers should keep paying their loans even if that no longer seemed to be in their economic interest. He said paying off a mortgage isn't only a matter of personal interest. Defaults hurt neighborhoods by lowering property values, Mr. Courson said. "What about the message they will send to their family and their kids and their friends?" he asked.

Falling membership and heavy debt costs related to the building have squeezed the MBA's finances in recent years. The MBA's membership totals about 2,400, down from a peak of 3,000 several years ago, but has increased recently, the spokeswoman said, and the organization expects to show a small surplus in its accounts for the fiscal year ending Sept. 30.

For more, see Mortgage Bankers Association Sells Headquarters at Big Loss by James R. Hagerty, February 6, 2010 at The Wall Street Journal. Thank you, The Daily Show.

Since I posted a description of the 2008 TARP earlier, here's a description of what is usually called the Stimulus Act which was signed into law by President Barack Obama on February 17, 2009, the $787 billion American Recovery and Reinvestment Act of 2009 at Wikipedia.

Another stimulus bill is the $152 billion Economic Stimulus Act of 2008 which was signed into law on February 13, 2008 by President Bush

Keynes believed that everyone stood to gain from public investments that could foster collaboration between employers and workers based on shared gains from national growth.In today's global economy, however, employers have less incentive to collaborate with workers than they once did. Multinational firms can easily relocate to low-wage, low-tax havens. With one click of a mouse, shareholders can move their capital out of the United States into mutual funds invested entirely in emerging markets, including China.

In other words, the cross-class coalition that supported strong state participation in the United States economy in the post-World War II has come undone.

He would explain our current shortfall of aggregate demand as the result of a tragic shortfall of national solidarity.

For more, see What Would Keynes Say Today? by Nancy Folbre, October 4, 2010 at Exonomix Blog, New York Times.

From How Controversy Works, by Zach Weiner, October 1, 2010 at SMBC.

A lawsuit to prevent the company's owners (shareholders) from influencing the company ...

The United States Chamber of Commerce and the Business Roundtable on Wednesday sued the Securities and Exchange Commission to overturn a rule that makes it easier for investors to oust corporate directors, arguing the provision gave activist investors too much leverage, Bloomberg News reported.The rule, which allows shareholders who own 3 percent of a company to nominate board members to corporate ballots, was narrowly approved by the S.E.C. in August.

This special- interest-driven rule will give small groups of special-interest activist investors significant leverage over a business's activities,said David Hirschmann, president of the chamber's Center for Capital Markets Competitiveness.The chamber, a business lobby, has said that if given more power to nominate directors, labor unions and public pension funds would hijack companies and push political agendas. But Mary L. Schapiro, the S.E.C. chairman, has said that the 2008 crisis, which cost financial firms more than $1.82 trillion, shows that shareholders need more say on board members.

From S.E.C. Sued over Board Nomination Rule for Investors by Andrew Ross Sorkin, September 30, 2010 at DealBook.

From Jail and Jobs by Catherine Rampell, September 29, 2010 at Exonomix Blog, New York Times.

Funny ... From Bill O'Reilly, September 27, 2010 at The Daily Show.

A good description of who got what and paid how much back is at The Bailout Yearbook: The Stars and the Slackers by Karen Weise, September 30, 2010 at ProPublica.

There is a revolution brewing in the country, and it is not just on the right wing but in the radical center. I know of at least two serious groups, one on the East Coast and one on the West Coast, developingthird partiesto challenge our stagnating two-party duopoly that has been presiding over our nation's steady incremental decline.President Obama has not been a do-nothing failure. He has some real accomplishments. He passed a health care expansion, a financial regulation expansion, stabilized the economy, started a national education reform initiative and has conducted a smart and tough war on Al Qaeda.

But there is another angle on the last two years: a president who won a sweeping political mandate, propelled by an energized youth movement and with control of both the House and the Senate — about as much power as any president could ever hope to muster in peacetime — was only able to pass an expansion of health care that is a suboptimal amalgam of tortured compromises that no one is certain will work or that we can afford (and doesn't deal with the cost or quality problems), a limited stimulus that has not relieved unemployment or fixed our infrastructure, and a financial regulation bill that still needs to be interpreted by regulators because no one could agree on crucial provisions. Plus, Obama had to abandon an energy-climate bill altogether, and if the G.O.P. takes back the House, we may not have an energy bill until 2013.

Obama probably did the best he could do, and that's the point. The best our current two parties can produce today — in the wake of the worst existential crisis in our economy and environment in a century — is suboptimal, even when one party had a huge majority.

For more, see Third Party Rising by Thomas L. Friedman, October 2, 2010 at The New York Times.

An electorate unschooled in basic budget facts is a major obstacle to controlling the nation's deficit, not to mention addressing a host of economic and social problems. We suggest that everyone who files a tax return receive ataxpayer receipt.This receipt would tell them to the penny what their taxes paid for based on the amount they paid in federal income taxes and FICA.

For much more, see A Taxpayer Receipt by David Kendall and Jim Kessler, September, 2010 at third way. Thank you, Ezra Klein.

[Meg] Whitman is representative of an emerging Republican type — what you might call the austerity caucus. Flamboyant performers like Sarah Palin get all the attention, but the governing soul of the party is to be found in statehouses where a loose confederation of über-wonks have become militant budget balancers. Just as welfare reformers of the 1990s presaged compassionate conservatism, so the austerity brigades presage the national party's next chapter.Mitch Daniels, the governor of Indiana who I think is most likely to win the G.O.P. presidential nomination in 2012, is the spiritual leader. Gov. Chris Christie of New Jersey is the rising star. Jeb Bush is the eminence. Gov. Bobby Jindal of Louisiana and Rob Portman, a Senate candidate in Ohio, also fit the mold.

These are people who can happily spend hours in the budget weeds looking for efficiencies. They're being assisted by budget experts from the Hoover Institution, the Manhattan Institute and freelancers like Bob Grady, who did budgeting in George H.W. Bush's administration. Members of the caucus have a similar sense of the role history has assigned them.

This state had a party for 10 years and I'm the guy who got called in to clean up the mess,Christie says.

For more, see The Austerity Caucus by David Brooks, September 30, 2010 at The New York Times.

This describes what should have been started two years ago.

People say the government should be run more like a business. So imagine yourself as CEO. Your bridges are crumbling. Your air-traffic control system doesn't use GPS. The Society of Civil Engineers gave your infrastructure a D and estimated that you need to make more than $2 trillion in repairs and upgrades. Sorry, chief. No one said being CEO was easy.But there's good news, too. Because of the recession, construction materials are cheap. So is labor. And your borrowing costs? They've never been lower. That means a dollar of investment today will go much further than it would have five years ago—or than it's likely to go five years from now. So what do you do? If you're thinking like a CEO, the answer is easy: you invest.

That's what the administration is proposing to do. But their plan is too modest. The $50 billion bump in infrastructure spending it outlined is only for surface transportation. And as for our water systems, schools, and levees? This is not a time for half measures. It's a rare opportunity to do what we need to do—and save money doing it.

Unemployment in the construction sector is at 17 percent—and that doesn't even count the construction workers who've given up looking for jobs.There's work that needs to be done,Larry Summers, outgoing chairman of the National Economic Council, told me.There are people there to do it. It seems a crime for the two not to be brought together.As for debt, delaying a dollar of needed repairs is no different from racking up a dollar the government owes.

You run a deficit both when you borrow money and when you defer maintenance,Summers says.Either way, you're imposing a cost on future generations.Plus, if America has to borrow money, now is the time. The interest rate on 10-year Treasuries is less than 3 percent—the lowest it has been since the 1950s. So a dollar of debt is cheap, and a dollar of infrastructure investment goes far. [Emphasis added].

The problem is that the process by which we choose infrastructure projects is embarrassing. About 10 percent of infrastructure spending comes from earmarks. Most of the rest depends on a formula in which the government just hands money to the states. There's no requirement for cost-benefit analysis. The decisions are horribly politicized. If taxpayers are making a huge investment in our nation's infrastructure, then we're owed an assurance that policymakers are choosing the best projects. That suggests a grand compromise in which more infrastructure money is tied to reforms ensuring a better process for spending that money.

For more, see If You Build It ... Now's the Time to Invest in Infrastructure by Ezra Klein, October 02, 2010 at Newsweek.

Researchers from the independent Pew Forum on Religion and Public Life phoned more than 3,400 Americans and asked them 32 questions about the Bible, Christianity and other world religions, famous religious figures and the constitutional principles governing religion in public life.

Among the topics covered in the survey were: Where was Jesus born? What is Ramadan? Whose writings inspired the Protestant Reformation? Which Biblical figure led the exodus from Egypt? What religion is the Dalai Lama? Joseph Smith? Mother Teresa? In most cases, the format was multiple choice.

On questions about the Bible and Christianity, the groups that answered the most right were Mormons and white evangelical Protestants.On questions about world religions, like Islam, Buddhism, Hinduism and Judaism, the groups that did the best were atheists, agnostics and Jews.

One finding that may grab the attention of policy makers is that most Americans wrongly believe that anything having to do with religion is prohibited in public schools.

For more, see Basic Religion Test Stumps Many Americans by Laurie Goodstein, September 28, 2010 at The New York Times.

More stuff I didn't know is at Physicists Claim to Have Spotted Sought-After Hawking Radiation by Andrew Moseman, September 27, 2010 at Discover Magazine blogs.

And more detail is at How to Build a Warp Drive Using Metamaterials, September 29, 2010 at MIL Technology Review.

Helped by looser fundraising rules, about two dozen organizations intended to benefit Republicans are active this fall in House and Senate races; fewer than 10 are aimed at helping Democrats. Ad spending by GOP allies over the past two months has totaled nearly $30 million in 15 states with competitive Senate or House races; Democratic outside groups have spent less than $5 million.

The financial advantage by outside GOP groups makes up for anemic fundraising by the Republican Party. The party's national committees trail their Democratic counterparts in overall contributions and overall cash on hand.

The GOP groups appear to be benefiting from a Supreme Court ruling earlier this year that freed big business — which typically leans Republican — to spend their millions directly to sway federal elections. What's more, several of the groups are set up as nonprofit corporations under the Internal Revenue Service code, and they don't have to reveal their donors."You've gone to a world where the Supreme Court has said corporations have a constitutional right to do this spending," said Trevor Potter, a campaign finance lawyer who was counsel to John McCain's Republican presidential campaign. "That green light has been very important."

For more, see Republican Groups Overwhelm Democrats with TV Ads by Jim Kuhnhenn and Liz Sidoti, September 27, 2010 at The Huffington Post.

As the mortgage market grew frothy in 2006 — leading to a housing bubble that nearly brought down the banking system two years later — ratings agencies charged with assessing risk in mortgage pools dismissed conclusive evidence that many of the loans were dubious, according to testimony given last week to the Financial Crisis Inquiry Commission.The commission, a bipartisan Congressional panel, has been holding hearings on the origins of the financial crisis. D. Keith Johnson, a former president of Clayton Holdings, a company that analyzed mortgage pools for the Wall Street firms that sold them, told the commission on Thursday that almost half the mortgages Clayton sampled from the beginning of 2006 through June 2007 failed to meet crucial quality benchmarks that banks had promised to investors.

Yet, Clayton found, Wall Street was placing many of the troubled loans into bundles known as mortgage securities.

Mr. Johnson said he took this data to officials at Standard & Poor's, Fitch Ratings and to the executive team at Moody's Investors Service.

We went to the ratings agencies and said, ‘Wouldn't this information be great for you to have as you assign tranche levels of risk?'Mr. Johnson testified last week. But none of the agencies took him up on his offer, he said, indicating that it was against their business interests to be too critical of Wall Street. [Emphasis added].

If any one of them would have adopted it,he testified,they would have lost market share.

For more, see Raters Ignored Proof of Unsafe Loans, Panel Is Told by Gretchen Morgenson, September 26, 2010 at The New York Times.

Researchers at the University of Toronto asked college students to shop online for products at either an eco-friendly or a normal store. When asked afterwards to divide a small amount of money between themselves and a stranger, those who went the eco route gave less to the stranger:

When we engage in a good deed, that gives us a kind of satisfaction,says Nina Mazar, professor of marketing and a co-author of the paper. With that self-satisfied feeling can come tacit permission to behave more selfishly next time we have the opportunity, Mazar says. Previous research has documented this licensing effect in other contexts; a study published last year revealed that asking people to ruminate on their humanitarian qualities actually reduced their charitable giving.

From Mean Greenies by Andrew Sullivan, September 25, 2010 at The Daily Dish.

Duh ...

Writing in the journal Psychological Science, University of Waterloo psychologists Karina Schumann and Michael Ross report that men are, indeed, less likely to sayI'm sorry.But they're also less likely to take offense and expect an apology from someone else.Their conclusion is that

men apologize less frequently than women because they have a higher threshold for what constitutes offensive behavior.Whether on the giving or receiving end, males are less likely to feel an unpleasant incident is serious enough to warrant a statement of remorse.

For more, see Real Men Do Apologize by Tom Jacobs, September 23, 2010 at Miller-McCune.

Orville Schell of the Asia Society, one of America's best China watchers, who was with me in Tianjin, put it perfectly:Because we have recently begun to find ourselves so unable to get things done, we tend to look with a certain overidealistic yearning when it comes to China. We see what they have done and project onto them something we miss, fearfully miss, in ourselves— thatcan-do,get-it-done,everyone-pull-together,whatever-it-takesattitude that built our highways, dams and put a man on the moon.

These were hallmarks of our childhood culture,said Schell.But now we view our country turning into the opposite, even as we see China becoming animated by these same kinds of energies. I don't idealize China's system of government. I don't want to live in an authoritarian system. But I do feel compelled to look at China in an objective way and acknowledge the successes of this system.That doesn't mean advocating that we become like China. It means being alive to the challenge we are up against and even finding ways to cooperate with China.The very retro notion that we are undisputedly still No. 1,added Schell,is extremely dangerous.

For more, see Too Many Hamburgers? by Thomas L. Friedman, September 21, 2010 at The New York Times.

With the Senate close to voting on the defense authorization bill, Congress is poised to pass the largest military budget since World War II — roughly $550 billion, excluding funds for the Iraq and Afghanistan wars.

Citing the need for austerity, Pentagon officials have a goal of 1 percent real growth in the Defense Department budget over the next decade. Not exactly a revolution of fiscal discipline.Hawks and defense industry trade groups say this spending is essential to U.S. security. But much of Washington's military spending is geared toward defending others and toward the dubious proposition that global stability depends on U.S. military deployments.

Washington confuses what it wants from its military (global primacy or hegemony) with what it needs (safety).

For more, see Drop Pretension to Supremacy by Benjamin H. Friedman and Christopher Preble, September 21, 2010 at Cato Institute.